Should you install a tracking device or app that allows your insurance company to monitor your driving in hopes of receiving a discount?

Insurance companies routinely offer discounts if you install a physical tracking device on your vehicle or use their app to monitor how you drive. Some let you get discounts if you meet certain criteria, such as driving below a certain number of miles per month.

But, what does this really mean for you?

On the one hand, you get some extra money in your pocket. On the other, companies whose primary goal is to not pay you money if you get into an accident can monitor your every move as you drive.

So what should you do?

What Do Car Insurers Do With Your Data?

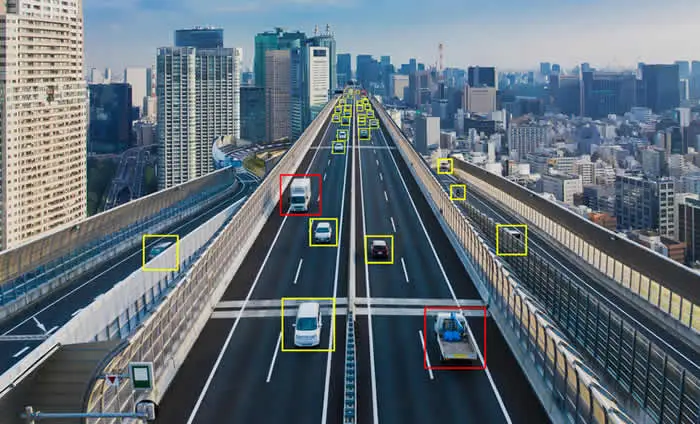

Car insurance companies aren’t fully transparent about the data they gather from you. They’ll usually monitor:

- Your speed

- The time of day you drive

- How you use your brakes

- Your parking location

- Your mileage

- How you turn

- Phone usage

If you’re generally a safe and responsible driver, you might benefit from apps and telematics devices, as they’re called. But some insurers also simply raise your premium, not based on your driving habits at all, but simply to recoup the discount you were given.

Insurers also routinely use this data to penalize drivers with greater risk or unsafe driving habits.

Also, they can (and do) use this data to raise your premium if you have a long commute on an unsafe road. Of course, neither of those factors is within your control!

In 2015, Pew Research conducted a survey on Americans’ trust of car insurers who track their driving habits.

Just 35% of those surveyed would allow insurance companies to track how they drive. And 45% thought that the risks of allowing their driving to be tracked would outweigh the benefits.

And, if you’re in an accident, even if it’s not your fault, insurers may use the collected data against you to minimize your claim, or deny it entirely.

The problem is tracking apps and devices fail to take into consideration the behavior of other drivers.

So, let’s say you swerve hard to avoid another reckless driver. Well, an app or telematics device only shows that you swerved hard. It can’t show why.

And then the insurer can construct a story blaming you for swerving hard so they don’t have to pay as much (and hopefully nothing at all).

What Else Do Insurers Do with Your Information?

Insurers have more uses for your private information than to simply invent reasons to deny your claim.

Several leading insurers say (make sure to read all the fine details) they will sell your data to advertisers.

And understand this also gives your insurance company the power to decide what safe driving is and isn’t.

So, that means they can set the bar so high for the data they collect that practically no one holds onto their discount.

Now, they have your information which they intend to use against you, and you don’t have your discount.

Who just won that deal?

Do You Really Think Insurers Want You To Pay Less?

Insurers happily offer up-front and ongoing discounts for safe driving. And since they can possibly save tens of thousands of dollars by denying or minimizing a claim for you in the future, it’s a good deal…for them.

After reading all this, you have to ask yourself, “Do insurers really give discounts for installing tracking apps and devices because they want me to save money?”

If you want to truly save money, you’re better off driving safe in the first place so you minimize your chances of being in an accident.

Don’t try to “save money” with your car insurer. No matter how much they say it, they’re not “on your side.”

Suggested Reading

Tactics insurance companies use to reduce or deny claims

What can you do if the insurance company denies your claim?

How can you reduce or eliminate cell phone use while driving?